Kalpa Versapay Connect for Acumatica

“Stop Losing Cash to Manual AR. Automate Collections & Recover Weeks of Cash Flow”

Kalpa Versapay Connect is an Acumatica connector that automates AR with near real-time payment visibility and configurable sync, eliminating manual invoice emailing, payment posting, and reconciliation without middleware or IT involvement. Most customers see DSO improvement in 90 days.

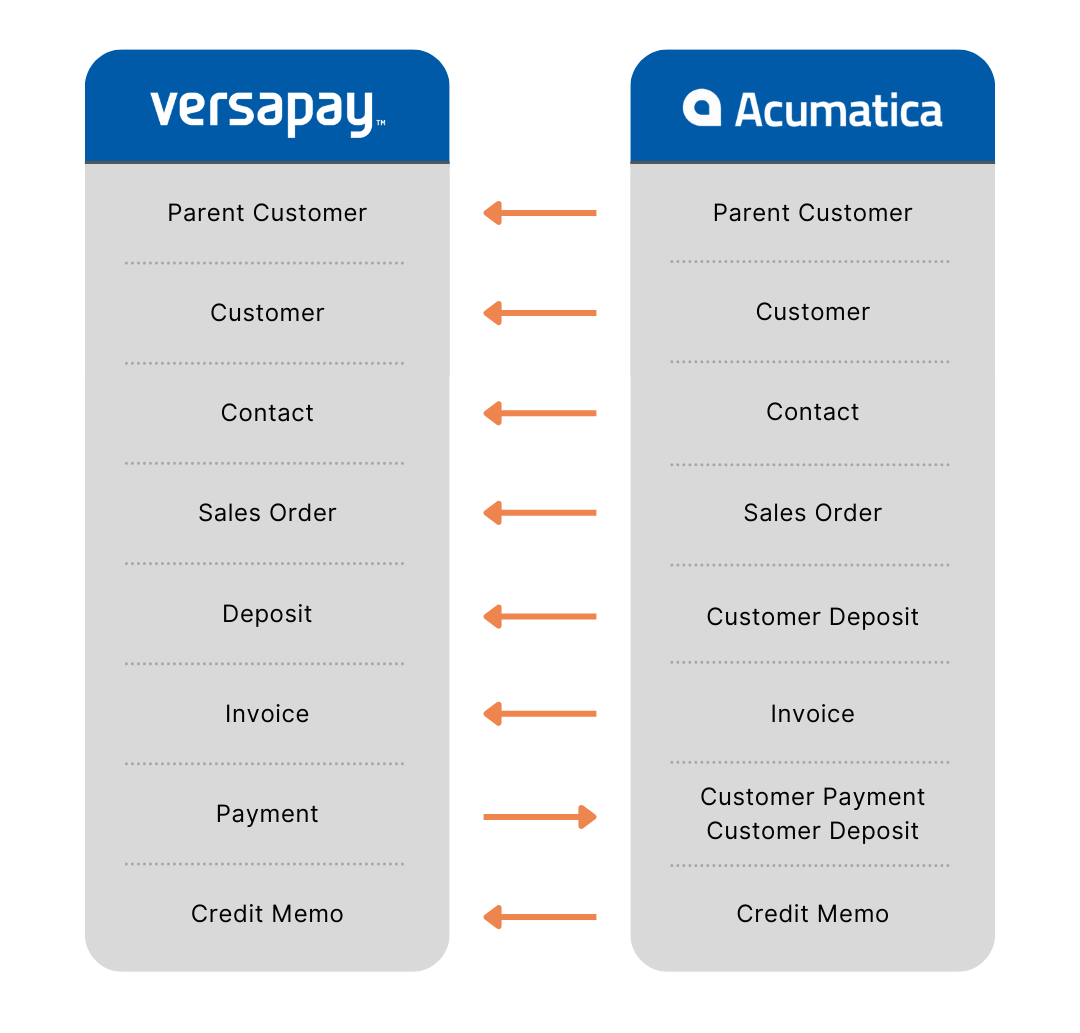

Supported Records at Launch

Platform Compatibility

Batch SFTP feed aligns with Versapay’s recommended high-volume pattern.

Uses Acumatica’s built-in SFTP Connector for secure credentials & key rotation

Uses Versapay APIs to sync data between systems to maintain security and has full audit capabilities.

Key Product Features

-

Open invoices export automatically; payments and deposits import and auto-apply without spreadsheet juggling.

-

Invoices flow to Versapay with pay-now links; settlements post in near real-time (configurable), providing faster visibility into customer payments.

-

All data moves only between NetSuite and Versapay via APIs, every transaction is time-stamped and logged.

-

Batch feeds routinely process tens of thousands of invoices in near real-time (configurable frequency) without performance impact.

-

Kalpa patches and validates every Acumatica update; no middleware latency or version conflicts.

-

Automates invoice distribution, payment posting, and reconciliation; frees time for collections strategy instead of data entry.

-

AR and finance see customer payments posted and fully matched the morning after processing, enabling accurate DSO tracking.

| Challenge | How Kalpa Fixes It |

|---|---|

| Spreadsheets & manual cash-matching | Exports open Invoice records in near real-time (configurable); imports Customer Payments/Deposits and auto-applies them automatically. |

| Slow, paper-based collections drive high DSO | Emails invoices with pay-now links and posts settlements next morning, accelerating cash by 13-22%. |

| Security & audit worries | Data moves only between Acumatica and Versapay via encrypted APIs; every line is time-stamped in Acumatica logs. |

Why Sales Ops & Finance Choose Kalpa

Frequently Asked Questions

-

Industry data shows 13–22% DSO improvement within six months of AR automation.

-

Kalpa ships compatibility patches for every Acumatica release.

-

Keys reside in VersaPay in accordance with PCI regulations and do not leave the application.